🗳️Yönetim Kasası (Governance Vault)

Alpaca's governance vault is a fork of Curve DAO’s governance. We believe this is one of the best models to align the incentives of the platform with loyal token holders.

You’ll be able to choose how long you want to lock up your ALPACA tokens, from a minimum of 1 week to a maximum of 1 year. In return, you will receive xALPACA tokens which will represent your share in the governance rewards pool as well as your voting power for the upcoming governance functions in Q1 2022.

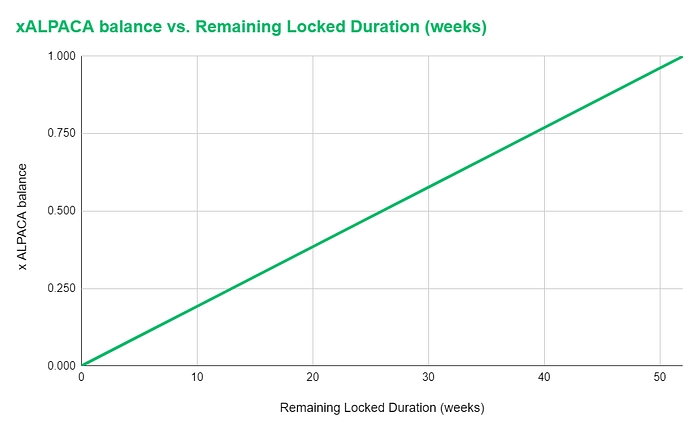

The amount of xALPACA you’ll receive will be calculated based on the amount of ALPACA deposited and the remaining lock duration, where 1 ALPACA locked for one year = 1 xALPACA. Your xALPACA balance will decrease linearly over time and will reach 0 when it’s unlocked.

The longer you lock up for, the more xALPACA you will receive, which translates into a higher multiple on your rewards APY and governance voting power.

Example 1:

Alice locked 100 ALPACA for 52 weeks and received 100 xALPACA

26 weeks have passed. Alice’s xALPACA balance became 50

Example 2:

John locked 100 ALPACA for 26 weeks, and received 50 xALPACA

Feeling like a llama, John then decided he’d prefer to get a higher multiple on his rewards so he extended his lockup from 26 to 52 weeks, and received an additional 50 xALPACA, bringing his total balance to 100 xALPACA

💡 Pro tips

- To ensure you always get the maximum APY on your governance rewards, you can extend your lockup period (to the max. 52 weeks) every week before the snapshot is taken

- You can add ALPACA to your locked position or extend the locked duration at any time

- You can only have one locked position for each wallet address. If you wish to have multiple locked positions with different durations, you can use multiple wallets

- Unlock also happens weekly at the same time as rewards distribution, at approx. 00:01 every Thursday

🎁Rewards for Participants

By locking up your ALPACA, you will be entitled to receive ALL the following rewards

1. ALPACA Emissions

A️ portion of ALPACA emissions are distributed to governance vault stakers — 300 allocation points (~0.355 ALPACA / block.) These rewards will be shifted from the ibALPACA staking pool.

2. High-Leverage Automated Vault Allocation

Automated Vaults above 4x leverage currently only offer private allocation for ALPACA governance stakers, at the rate of $1 of locked ALPACA = $1 of Automated Vault allocation. More info here.

3. Grazing Range Pool Rewards

Governance vault stakers earn token rewards from all future Grazing Range pools. Moreover, you do not have to choose which pool to stake in. If there are multiple pools running concurrently, you are eligible to receive rewards from all of them! The yields stack up for you. To see the list of Grazing Range pools for governance vault stakers, please visit here.

4. Platform Revenue Sharing

To align closer to market rates, and give more benefits to ALPACA holders, as of Dec 23, 2021, we are adjusting the leveraged yield farming performance fee to 9% (on yield farming rewards portion only). Of this, 5% will go to Protocol APR for the ALPACA stakers in the governance vault (as an ALPACA buyback).

This is a new revenue stream for ALPACA stakers that brings in an additional ~2.6Mn/year or ~$50k/week (based on metrics at time of launch) as rewards to them, adding a consistent income channel on top of the existing Protocol APR, Grazing Range rewards, and long-term deflationary benefits through buyback & burn that ALPACA holders enjoy.

5. Governance Voting Power

More xALPACA = more votes for governance proposals. This is coming in the second half of the product release for this governance vault in Q1 of 2022.

⏰Rewards Distribution Mechanism

Due to the smart contract structure, rewards are distributed on a weekly basis.

Each week, we take a snapshot of users’ xALPACA balances at 23:59 UTC Wednesday. This balance is then used to calculate each user’s share of the rewards accrued in the following week. Rewards then become available to claim every following Thursday.

Let’s look at an example to further clarify this concept.

The first snapshot is at 23:59 UTC on Wednesday the 22nd of December.

All the users that lock their ALPACA in the governance vault before 23:59 UTC on the 22nd of December become eligible for the rewards that accrue from 23rd December to 30th December.

Rewards for that week then become available to claim after 00:01 UTC on the 30th of December.

💡 Pro tips

Make sure you make any adjustments to your locked positions(such as extending lockup for a higher multiplier or adding more ALPACA) by 11.59PM UTC Wednesday to get the max allocation from the following week’s rewards.

Last updated

Was this helpful?