Leveraged Yield Farming

Leveraged Yield Farming will be built on top of the AF2.0 Money Market. As before, it will enable users to borrow under-collateralized loans to farm on whitelisted yield sources with auto-compounding. Yet of course, there are many new features, which we discuss below.

1️ Cross Margin and Sub-accounts

Cross margin has been one of the most requested features by users, and we will provide this functionality in the new LYF.

AF2.0 will also offer a sub-accounts feature, which will allow for creating multiple sub-accounts within each wallet, where exposure will be isolated within each sub-account. Users will be able to choose which positions can act as cross-margin to each other by grouping them in a sub-account.

This will enable users to better customize exposures and control risk.

2️ Configurable interest rates

We want to once again highlight here that farms in the LYF module could be configured to have different borrowing interest rates. Farms with lower yields but also lower risks (e.g. stablecoin pairs) could once again become profitable through this flexibility.

At the same time, farms with volatile assets but with high APYs could be set with higher interest rates to compensate for their higher risks, yet still remain very profitable. In aggregate, this improved fine-tuning and matching of interest rates will make LYF much more efficient, and should provide higher revenues to ALPACA governance stakers.

Below is an example of a configuration where depending on the pool, LYF charges 3 different interest rates for borrowing BUSD:

2% on USDT-BUSD farm 8% on BNB-BUSD farm 12% on SmallAlt-BUSD farm

3️ Flexible collateral types and Borrowing Assets

In the current LYF, collateral assets are limited to the assets in the farming pairs. For instance, farming in the BNB-BUSD pair only allows BNB or BUSD to act as collateral. However, that limitation is about to disappear.

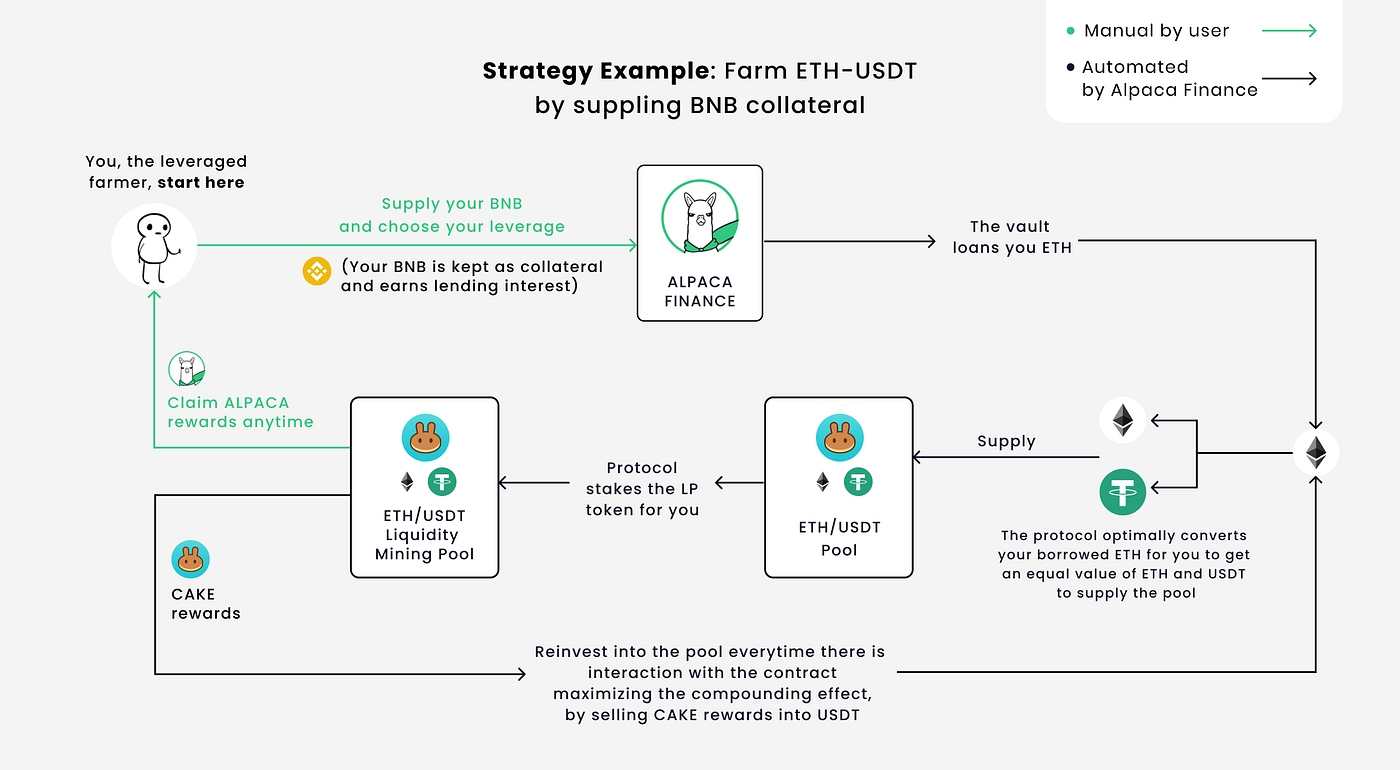

AF2.0 will allow any Collateral-tier asset to be used as collateral on any LYF pair whatsoever. So for example, users could provide BNB as collateral, and borrow ETH to farm in the ETH-USDT pair (going short ETH and maintaining 1xlong BNB exposure)

Or users could provide BNB as collateral, to borrow BUSD to farm in the BUSD-USDT pair (keeping exposure to BNB but farming a low volatility stablecoin pair).

Etc.

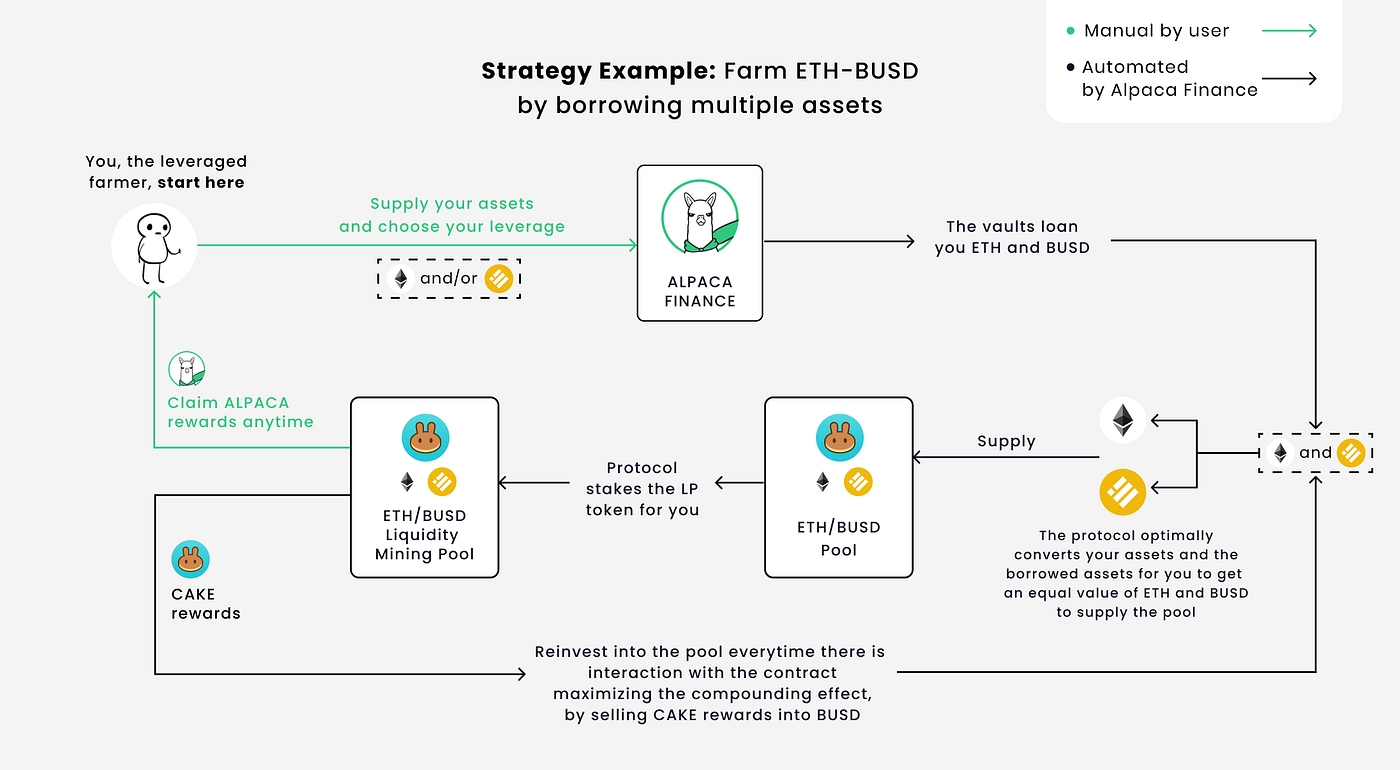

In addition to flexible collateral types, borrowing will also become more versatile by allowing the borrowing of multiple assets in a single LYF position. This will allow for certain strategies (e.g., market neutral in Automated Vaults) to be achieved more efficiently and cheaply, without the common costs of opening a position.

Moreover, the smart contract will even have the capability to permit it so that unrelated assets can be borrowed for farming!

For example, users could borrow BTC to farm BUSD-USDT (short BTC at a fixed, high leverage while farming a low volatility pair). The BTC would be sold into the farming assets.

This market-leading flexibility on collateral and borrowing assets, combined with cross-margin and sub-accounts, will allow users to manage some of the most complex investment strategies DeFi can currently support, while doing so all in one platform, which provides advanced controls to minimize their risks. Within DeFi, having this kind of versatility for exposure customization, while also being able to access a wide array of yield-generating opportunities hosted internally, and all within a decentralized format, is extremely rare, if not unheard of! We hope you enjoy it! 😊

4️ Multi-rewards for farmers

In AF2.0, farming incentive rewards will be allocatable on a per-pool basis. So we will be able to prioritize incentives on certain pools.

Each pool will also support multiple reward tokens (e.g., ALPACA & TokenX). Thereby, Grazing Range partners will be able to provide tokens as incentives for their tokens’ farms to further attract users to open leveraged positions on their tokens. This can help bootstrap the liquidity of their token pools, while also expanding the reach of their tokens to a wider audience of LYF users.

While we have done the above with some partners in the past, the implementation effort was high since we had to rely on subgraphs. Consequently, the collaborations have been limited to only a couple of selected projects. AF2.0 will allow for a more seamless integration with our partners, increasing the value proposition of our Grazing Range program. This should incentivize more partners to join the Grazing Range program, which will create more yield opportunities for our users and generate more partner rewards for ALPACA stakers in governance.

Last updated

Was this helpful?