Lesson 5 - The Truth About Impermanent Loss and Common Misunderstandings

Impermanent Loss…the dreaded term. You’ve heard about it, you’ve read about it, but do you really understand it? In this article, we senior alpacas will give our take on the subject that haunts all yield farmers. So put on your reading glasses and let’s explore IL together.

📉What is Impermanent Loss?

Impermanent loss(IL) occurs as a result of asset rebalancing by the Automated Market Maker(AMM) as prices of the assets(tokens) in an LP position diverge from their starting ratio to each other. IL is the equity loss of an asset in an LP when compared to simply holding said asset by itself.

Still doesn’t mean anything? Don’t worry. let’s walk through a simple example together so this definition becomes clearer to you.

Let’s assume Alice has 10 BNB and 3,200 BUSD, and decides to provide liquidity in the BNB-BUSD LP pool. For simplicity, we will assume 1 BNB = 320 BUSD so her assets are in an exact 50:50 ratio, which is necessary for the LP.

t= 0 (time period = 0, starting time) Alice’s assets = 10 BNB + 3,200 BUSD = 6,400 BUSD worth

Some time passes and BNB price has gone up by 25% to 1 BNB = 400 BUSD. Because her assets were in the LP pool during this price movement, they were re-balanced to maintain the 50:50 ratio of BNB:BUSD. Thus, her assets in the pool became:

Farming in LP t=1 Alice’s assets = 8.94 BNB + 3,577.71 BUSD = 7,155.42 BUSD worth

(8.94 * 400 = 3,577.71 * 1)

So overall, Alice has made a profit of 7,155.42 — 6,400 BUSD = 755.42 BUSD

Profits are always nice, but why do some people complain about Impermanent Loss in this type of scenario? Where is the loss? Well, let’s compare this to what would have happened if Alice hadn’t put her assets into the LP pool but rather held them in her wallet from t=0 to t=1.

Held in Wallet t=1 Alice’s assets = 10 BNB + 3,200 BUSD = 7,200 BUSD worth

So by being in an LP position, Alice’s loss was 44.58 BUSD, 0.62% worse off than if she had just held the assets. This difference of 44.58 BUSD is an example of Impermanent Loss.

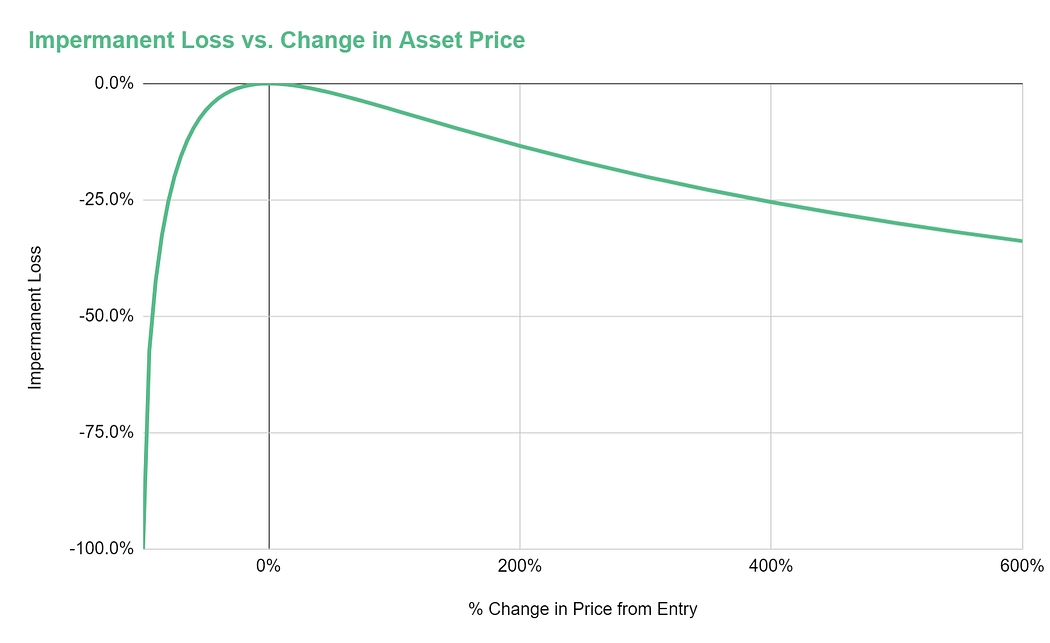

You may have seen a chart like the one below that shows the effect of Impermanent Loss as price moves away from your entry. At first, the chart might seem terrifying, with a steep curve to the left going all the way down to -100%! However, upon closer inspection, we would argue that IL is no different than other types of investment risks where if you have a proper understanding of the risk and a sound game plan, you can mitigate any potential losses and bring this risk well within acceptable boundaries.

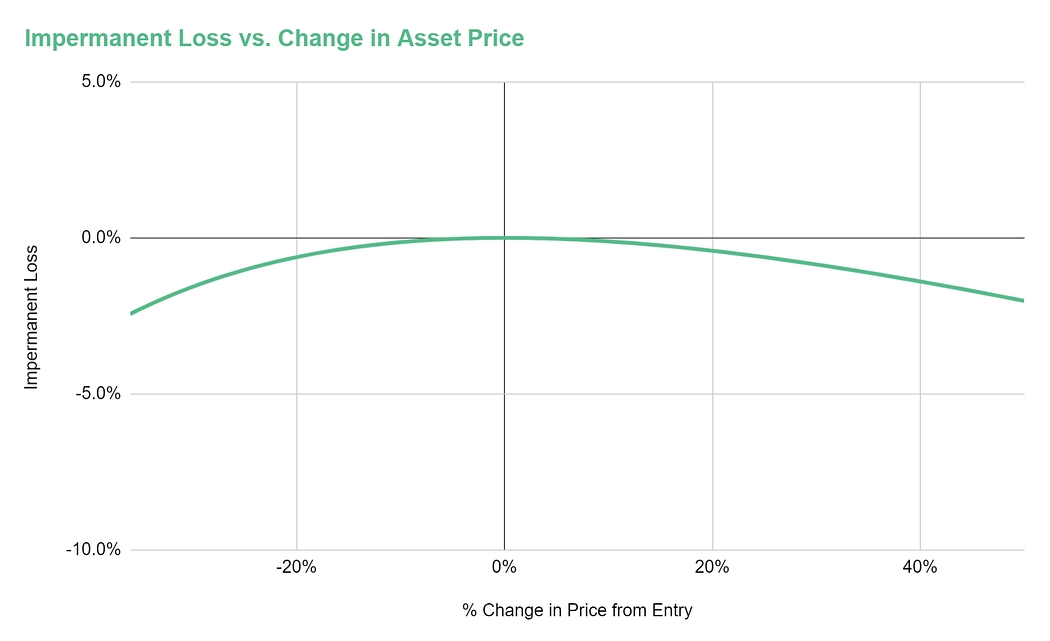

Let us zoom in a bit on the IL chart and only consider the price range near your entry point(chart below). The slope in this region is quite gentle. In fact, Impermanent Loss remains < 2% as long as the relative prices of the asset in your LP pair stay within 50% of your entry! In other words, IL is actually not a big factor in the short-term, or even medium-term with less volatile tokens. It’s something to be aware of, but not necessarily something to be feared, as long as you have a good understanding of it. We’ll help you with that now.

🤔Is Impermanent Loss really a loss?

One common suggestion we see time and time again in articles is for users NOT to remove their LP positions, to avoid the Impermanent Loss becoming permanent.

“Wait until the exchange rate returns to the initial rate before removing your LP position.”

However, this suggestion is misleading. This saying is no different than stock traders saying, “It’s not a loss until you sell.” In reality, there is nothing magical about an LP position that would make the loss more “impermanent” than if you were holding a stock that has gone down in price since you bought. In both scenarios, the price would have to move back to your entry point for the loss be to erased.

As proof that removing liquidity in an LP does nothing to affect Impermanent Loss, imagine the following scenario. If the prices of the assets in your LP position shifted and you accrued some Impermanent Loss, you can remove liquidity from your LP position. This is what the authors of the aforementioned quote would advise you not to do, implying the loss would become permanent.

However, if you were to remove liquidity from your LP, you could then add that liquidity right back in the same ratio of tokens, and find yourself in the exact same position you were in before you removed liquidity. Relative to your earlier entry prices, your Impermanent Loss would be the same. If prices of the assets returned to where they were at your first entry, your Impermanent Loss would become 0. How is that possible if by removing liquidity, your Impermanent Loss became permanent? The answer is it’s not.

What’s more is that if you removed liquidity and held the tokens outside of an LP, and then their prices returned to where they were at your first entry, you would have actually earned more than the “recovered Impermanent Loss.” That’s why Impermanent Loss is actually a misnomer, and there are other, better frameworks by which you can look at the concept.

💡Other ways to look at Impermanent Loss

We propose alternative ways to look at Impermanent Loss which shed light on ways in which you can use IL to your advantage.

What is actually happening during AMM asset rebalancing?

Asset rebalancing is the cause of Impermanent Loss, but how does asset rebalancing work? The truth is much simpler than you might think. Let’s say you have an LP pair of BTC-BNB at a starting ratio of 50:50 at entry. The actual prices of the assets are not important when considering asset rebalancing, only their relative price to each other. So instead of 50:50, let’s simplify the ratio to 1:1.

If BTC price rises 10% more relative to BNB price, then 1.1:1 becomes the new ratio before asset rebalancing. Now, the AMM needs to rebalance this into 1:1, so how does it do that? Simple: it sells BTC and buys more BNB, until the value ratio becomes 1:1. As BTC price continues to rise relative to BNB, the AMM continues selling BTC and buying BNB. When the price of BTC moves back down relative to BNB, the AMM does the opposite; it sells BNB and buys BTC.

Traders may be thinking to themselves that this looks familiar, and that’s for a good reason. This is similar to a strategy often used by traders called dollar cost averaging(DCA, or averaging). In essence, what the AMM is doing is a DCA on your tokens.

When the price of BTC rises relative to BNB, as in the example given before, the AMM is DCA selling out of your BTC position. As BTC’s relative price drops, the AMM is DCA buying, increasing your BTC position. Now, with that clear, another question surfaces: since this is a strategy traders often use, then can you utilize an AMM’s asset rebalancing as a trading strategy? The answer is yes!

Dollar-cost averaging accumulation

Suppose your goal is to accumulate BTC and you would be happy to buy more of it if the price went down because you think its price will rise in the long run and believe crypto is the future of finance(who doesn’t 😎). Instead of holding cash and setting buy orders at lower prices, another way to achieve this goal is to simply provide liquidity to a BTC-stablecoin LP pair. Because of the asset rebalancing that happens in the LP pool, your position would accumulate more BTC automatically as BTC price moves down! Your LP position, through the AMM’s algorithm, would perform dollar cost averaging, buying BTC at lower prices for you!

It’s true that your average buying cost would not be as good as catching the bottom. However, if we’re honest, how many of us truly manage to catch the bottom every time? 😅

Doing this through LP’ing can be seen as an automated strategy that executes while you’re sleeping, and it will avoid having to do guesswork on where the bottom might be. Most importantly, you’ll be earning yields the entire time! That’s why yield farming in LP positions is a great strategy for new to moderate traders with a long-term investment horizon!

As a supplement to this strategy, we’d also like to flip another concept on its head by suggesting that if you believe the price has bottomed, you‘d be better off exiting the LP and taking the “Impermanent Loss,” because you would benefit more as BTC’s price later rose!

Let’s walk through an example of how this would work:

Example:

Bob has 1 BTC and 40k BUSD in hand and decides to provide liquidity in the BTC-BUSD LP pool. For simplicity, we will assume 1 BTC = 40k BUSD at the time so his assets are in the exact 50:50 ratio for providing LP.

t= 0 Bob’s assets = 1 BTC + 40,000 BUSD = 80,000 BUSD worth

Some time passes and BTC price has dropped to 30k BUSD.

t = 1 Bob’s assets = 1.15 BTC + 34,641 BUSD = 69,282 BUSD worth

Bob believes that 30k is a strong support for BTC and likely the bottom. He thinks price will go up from here so he decides to withdraw his LP. Now, he receives back 1.15 BTC + 34,641 BUSD in his wallet.

Moving forward, let’s say Bob was correct and the price subsequently rose back to its starting price of 40k.

t=3 Bob’s assets =1.15 BTC + 34,641 BUSD = 80,641 BUSD worth

By withdrawing his LP when BTC was at 30k BUSD, Bob didn’t get exposed to asset rebalancing which would have sold back some of his BTC into BUSD as BTC’s price went back up. This resulted in him earning an extra 641 BUSD vs. where he started (not counting yields). As Bob became more confident in his future price prediction, he was able to make a relative profit by exiting his LP and shifting to simple holding.

Dollar cost averaging distribution

The following is the inverse of the above example. Suppose you are happy to partially take profits on a crypto asset when the price moves up. In this scenario, you can put some into an LP position. As the price rises, you will automatically dollar-cost-average sell your position through the AMM’s algorithm.

Similarly, if you think the price has topped, you can remove your LP and sell your tokens, to avoid the AMM buying them back as price moves down. If you wanted, you could then reenter at a lower price. Or, by using Alpaca, you could open a short position!

Betting on a sideways market, or uncertain market bias

As illustrated in the previous two sub-sections, LP’ing can be very useful for helping you hedge into and out of positions, to reduce risk when you don’t have certainty on market direction. For most that are not full-time professional traders, isn’t this usually the case? In reality, this is true even for professional traders, of whom many are correct on market direction only 55% of the time.

So although many of us are bullish on crypto and various assets, we don’t know if that inevitable breakout will happen in 1 month, 1 year, or 5 years. If it’s a longer period and we hold these assets in our wallets, we’d be missing out on a whole lot of potential interest that we could’ve earned if we participated in yield farming at a protocol like Alpaca!

That’s why you can also see LP’ing as a hedge against market timing! Even in the unfavorable scenario, if the breakout happens in a short time and you have some impermanent loss, the yields you earn can still make up for that!

Let’s examine the above circumstances in more detail. Traditionally, when you’re investing in a market, you would take the following actions:

If you’re bullish on a market or asset, you can buy it aka take a long position.

If you’re bearish on a market or asset, you can sell it aka take a short position.

But what if you’re uncertain? Should you just sit out with cash in the bank that’s earning close to 0 interest?

Or what if you think the market is in a period of rest? That it needs to consolidate for a while before a major up or down movement can occur, as often is the case in markets after periods of high volatility. After all, anyone who has traded for a while knows that markets can consolidate for long periods of time.

In a scenario of consolidation or uncertainty, a good investment strategy is deploying assets into an LP position. An LP position earns yields even if prices don’t move. Due to the DCA effect when an asset’s price goes up or down, you also have a hedge to the asset in both directions.

In this case, one example of a strategy you could use is simple LP’ing, such as opening an auto-compounding LP position without leverage. If you wanted to earn greater yields, you could use leverage and open a 2x position, borrowing a crypto asset at neutral, or take greater leverage on a long or short position with an asset of your choice. You could even open a hedged neutral position if you wanted extra risk mitigation, which would be easier to manage if asset prices didn’t move much.

The point is that almost any LP strategy will be profitable in a sideways market, much more profitable than a standard long or short due to earning yields, and you could further customize the type of strategy based on your risk tolerance and desired APYs using Alpaca. So whatever you decide to do, just know that as soon as you step onto the farm, you can be sure it’ll be all green as far as your eyes can see.

We hope this article shed some light on the topic of Impermanent Loss and how if you look at it through the lens of dollar cost averaging/hedging, it could turn into a tool that works in your favor, rather than something to be feared.

Thanks for joining us and that’ll be all for today, young alpacas. If you want to read more articles like this, don’t forget to check out our Alpaca Academy. Happy farming!

Last updated

Was this helpful?