Strategy 4: Multiply Crypto Gains in a Bull Market

Multiplying crypto gains in a bull market can be done most efficiently by levering up long positions. In the following article, we’ll show just profitable leveraged yield farming can be in such a scenario. However, in order to understand the strengths of leveraged yield farming for this goal, let’s first explore its cousin strategy, leveraged trading.

Advantages of Leveraged Yield Farming Over Common Leveraged Trading Strategies

When traders are confidently bullish on an asset, they often use leverage to increase their gains. For example, with margin trading, stock traders can borrow money to buy more stocks using their existing equity as collateral. Similarly, crypto traders can buy perpetual contracts (aka Perps) on CEXs, which lever up their positions, using crypto assets as collateral.

However, when you buy a Perp, both the Perp and the crypto asset used for collateral cannot be withdrawn from the CEX. This means leverage traders lose out on profitable farming opportunities (30–100% APYs are not uncommon) on these assets, which are ubiquitously provided by a plethora of DEXss and lending protocols within DeFi. What’s more is leverage traders have to pay borrowing interest, thus holding at a loss while their positions are open.

With leveraged yield farming (LYF), however, traders can lever up an asset AND earn farming yields on the equity and borrowed assets, making LYF much more capital efficient than leveraged trading. LYF is similar to standard farming of liquidity pairs on DEXs, but you have the additional option to borrow tokens to increase the size and subsequent returns of your farming position.

As a quick example, on Alpaca Finance, a user can deposit $10,000 worth of ETH, borrow $20,000 worth of USDT (3x leverage), and farm a position comprised of $15,000 in ETH and $15,000 in USDT — all in one click (Alpaca will automatically swap tokens to make a 50:50 farming pair; in this example, $5,000 worth of USDT was swapped for ETH). The user is now 1.5x leveraged on ETH, as the user now holds $15,000 worth of ETH compared to his initial position of $10,000 worth of ETH.

In addition to having a 1.5x leveraged long on ETH, the user will earn 42% APY on his $10,000 equity, as a result from earning higher farming yields on a position 3x the size of his equity. Therefore, if ETH rises, the user is not only earning multiplied gains on ETH but also multiplied farming yields.

Furthermore, compared to Perps which have an annual borrowing interest of 20–100% APR, the borrowing interest in leveraged yield farming is typically much lower at about 10–20% APR.

These advantages make leveraged yield farming a powerful and oftentimes superior tool for leveraged trading to multiply your gains in a bull market.

Some Leveraged Yield Farming Basics

If you’re already familiar with leveraged yield farming and how longs/shorts work in Alpaca, you can skip this section.

Before we describe how to create leveraged long positions using Alpaca’s LYF tools, it is critical you understand which crypto assets you have long or short exposure on when opening an LYF position. (Note: If you don’t know what shorting is, please read this article)

Luckily, calculating your initial crypto asset exposure is easy: You are long on the tokens in your farming position and short on the tokens you borrow. Your net exposure is the net value of the two.

When you open a position at Alpaca, in the Your Positions dashboard on the Portfolio page, you can see your Debt Value, which is the value of what you borrowed.

![]()

Debt Value here is 3.13 BNB

Debt Value here is 3.13 BNB

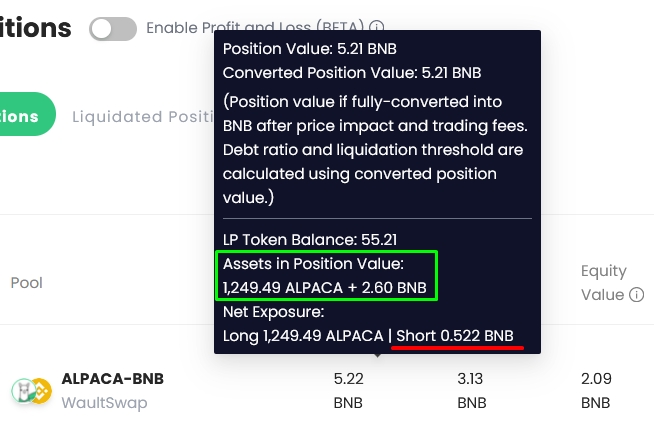

If you hover over Position Value, you can also see the breakdown of the value of the assets in your position, as well as your exposure.

![]()

Notice from the example above that when you subtract your Debt Value of 3.13 BNB from the BNB in your Position Value of 2.60, you get your approximate short exposure of -.522. (.008 off in the display due to UI rounding and calculating the value of swap fees when closing)

What Tokens You Deposit Does Not Matter Notice that when calculating your net exposure, the deposited tokens are never taken into consideration. What matters is 1) the amount of tokens in your initial farming position and 2) the amount of tokens you borrowed. From these, you can calculate your initial net long and short exposures.

However, what tokens you deposit does matter in terms of saving on swap costs (swap fees + impact costs). No matter what combination of assets you deposit, Alpaca will convert those into a 50:50 ratio which is necessary to open your farming position. So when opening a leveraged position above 2x, you can save in swap fees by depositing in the asset other than the one you are borrowing. (To learn more on how to save or avoid swap fees, you can read this article)

How to Create a Leveraged Long Farming Position

If you are confidently bullish on a crypto asset (e.g. ETH), you can create a leveraged long position on ETH by opening either:

1) an ETH-stablecoin farm, borrowing the stablecoin, and using > 2x leverage; or 2) an ETH-cryptoToken farm, borrowing the cryptoToken, and using > 2x leverage. Below, we describe an example for each.

Open an ETH-stablecoin farm, borrow the stablecoin, use >2x leverage

Expanding on the prior example, you can open an ETH-USDT position, depositing $10,000 worth of tokens, and choosing 3x leverage to borrow $20,000 worth of USDT. Alpaca will convert all deposited and borrowed tokens to a 50:50 farming position, which will consist of $15,000 in ETH + $15,000 in USDT. To calculate your initial net exposure, add the longs and shorts together (remember, you are long on the tokens you’re farming and short on the tokens you borrowed):

Long $15,000 worth of ETH ⇐ farmed tokens

Long $15,000 worth of USDT ⇐ farmed tokens

Short $20,000 worth of USDT ⇐ borrowed tokens

Therefore, your initial net exposure is long $15,000 worth of ETH (longing or shorting a stablecoin is neutral). You are levered 1.5x compared to your initial holdings of $10,000 in ETH. Furthermore, you will be earning 3x farming yields.

Open an ETH-cryptoToken farm, borrow the cryptoToken, use >2x leverage

For example, you can open an ETH-BNB farm, depositing $10,000 worth of tokens, and choosing 3x leverage to borrow $20,000 worth of BNB. Alpaca will convert all deposited and borrowed tokens to a 50:50 farming position, which will consist of $15,000 in ETH + $15,000 in BNB. Here is your exposure:

Long $15,000 worth of ETH ⇐ farmed tokens

Long $15,000 worth of BNB ⇐ farmed tokens

Short $20,000 worth of BNB ⇐ borrowed tokens

Therefore, your initial net exposure is long $15,000 worth of ETH and short $5000 worth of BNB. As a quick rule, when you use >2x leverage, you will have a slight short exposure on the borrowed asset. In regards to ETH, you are 1.5x long on ETH compared to your initial holdings of $10,000 worth of ETH. In addition, you will be harvesting 3x yields, which can be quite significant for pairs consisting of two crypto assets.

For this position to be more profitable than farming ETH-USDT, you’d prefer at least one of the following to be true:

The APY on farming ETH-BNB is higher than ETH-USDT.

You believe BNB price will drop (since you are short on BNB).

Modeling Your Profits Over Time

Your initial net exposure is likely to change over time. That is because when prices move, the composition of your LP tokens will change, shifting your long and short exposures. For example, when ETH rises, your LPs will contain less ETH (This happens because the AMM such as PancakeSwap will rebalance your assets. To understand how that works please read this article). Correspondingly, when ETH falls, your LPs will contain more ETH.

Tracking your long and short exposure over time in DeFi protocols can be quite complicated. Luckily, as we pointed out before in the section “Some Leveraged Yield Farming Basics,” on Alpaca Finance, you can hover your mouse over your position’s “Position Value” on the Portfolio page, and modal will pop up showing your real-time long and short exposures.

How much will you profit/lose when token prices move?

Below, we provide a graph showing how your Equity Value (the value of the assets you own and will receive when you close your position) would change when the price of the Non-Borrowed Asset (ETH) and Borrowed Asset (USDT or BNB) changes in a 3x leveraged farming position such as the ones in prior examples.

In the following graph, you can see that you are much more profitable leveraged farming than holding when the price of the Non-Borrowed Asset(long) rises OR stays flat, and you’re still more profitable in half the cases when the price suffers a modest drop! (-20% for green and -40% for blue). In other words, you are more profitable using leveraged farming in the majority of cases!

Several key observations are:

The dashed black line shows your equity value if you simply HODLed ETH in your wallet. As ETH’s price increases, your equity increases linearly.

If the Borrowed Asset’s price remains unchanged (e.g. if you borrowed stablecoins): a) Without considering yields, your equity follows the solid black line. When ETH rises, your equity significantly outperforms HODLing ETH because your ETH exposure is leveraged 1.5x. b) When considering 3x farming yields (green line), your equity will be even higher.

If the Borrowed Asset’s price changes (e.g. if you borrowed BNB), the curves will shift. Remember you have a slight short exposure on BNB. If BNB’s price falls (red line), your equity curve will shift up. If BNB’s price rises (blue line), your equity curve will shift down.

As ETH (the Non-Borrowed Asset) price rises to ~60%, whether you borrow or a stablecoin or a crypto asset becomes less significant. This is because as ETH rises, your LPs contain less ETH and more of that crypto asset, neutralizing your initial short position on that crypto asset.

At 3x leverage, the Non-Borrowed Asset relative to the Borrowed Asset (ETH/BUSD or ETH/BNB) will have to fall 36% before you risk liquidation (assuming a Liquidation Threshold of 83.3%). When using > 2x leverage, be particularly careful if the Non-Borrowed Asset falls while the Borrowed Asset rises, as this can accelerate the position towards liquidation. Learn more about liquidations in our Alpaca Academy Lesson 3.

You can play with all calculations and graphs, including how far assets must fall to risk liquidation, on our Yield Farming Calculator.

*Colored lines assume yield farming APR + trading fees APR at 1x leverage of 25%, borrowing interest APR of 15%, ALPACA rewards APR of 10%, and a 90-day farming duration.

In summary, if you are bullish on an asset (e.g. ETH), leveraged yield farming that asset is a more profitable strategy than simply holding it or yield farming it normally.

Most importantly, while you’re holding the leveraged position, you will be earning multiplied farming yields on your position, which over time, will make your position more profitable even if your chosen asset’s price remains flat, and in many cases, even if it suffers a modest drop!

For these reasons, leveraged yield farming is a general-purpose optimal strategy for multiplying your crypto gains in a bull market.

To read more articles on how to profit with Alpaca Finance, you can read about our Six Simple Strategies to Maximize Your Farming Yields With Alpaca Finance, and be sure to also check our Alpaca Academy for even more educational content.

Last updated

Was this helpful?