Traders

1️. Open Long/Short on BTCB, ETH, and BNB without slippage

When it first goes live, the Perpetual Futures Exchange will support the trading of these three assets. Based on our research, 90%+ of the futures trading volume is concentrated on BTC and ETH. Therefore, our Exchange will already capture a great majority of the market demand. However, we plan to add other assets over time to provide more choices to users.

The Exchange utilizes a pool liquidity system to facilitate trading (as opposed to an order book system). LPs will provide liquidity to the pool, and this liquidity will be reserved for positions as they open. With this structure, users will get an exact execution price, without slippage, regardless of trade size.

Unlike futures markets on CEXs where prices can deviate significantly from spot prices, users of our exchange will always execute their trades at an accurate spot price, which will be based on an aggregated oracle price feed.

2️. Low Opening/Closing Cost

In a typical futures exchange that uses an orderbook, there are two costs associated with opening/closing a position using a market order: trading fees and slippage. The trading fees are set based on each platform’s fee structure, while slippage occurs as a result of the orderbook thickness or the market-making formula.

Traders with larger positions will benefit from our Exchange’s no-slippage design and achieve lower costs when they trade.

Alpaca’s Perpetual Futures Exchange will also have a volume-based tiered trading fees discount, which is designed to be competitive. So the more you trade, the lower fee % you’ll pay, which should further cement traders’ loyalty to our platform.

3️. No Centralization Risk

100% of Alpaca Perpetual Futures Exchange’s collateral and liquidity will exist within verifiable and audited smart contracts. All trading transactions will execute transparently on-chain.

The moment each position opens, its corresponding potential profit will be locked up for the payout to that position. The smart contract cannot and will not open a position if the payout of its profit cannot be 100% guaranteed.

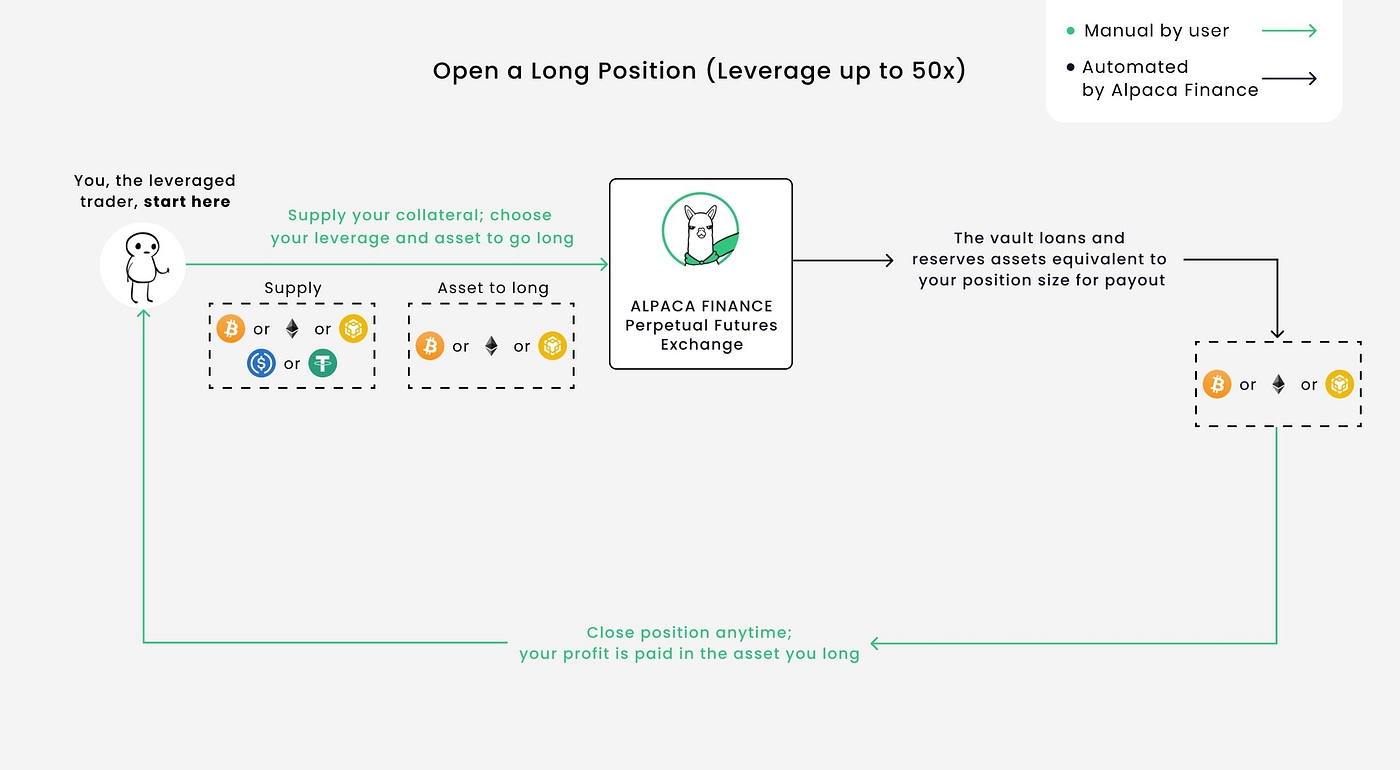

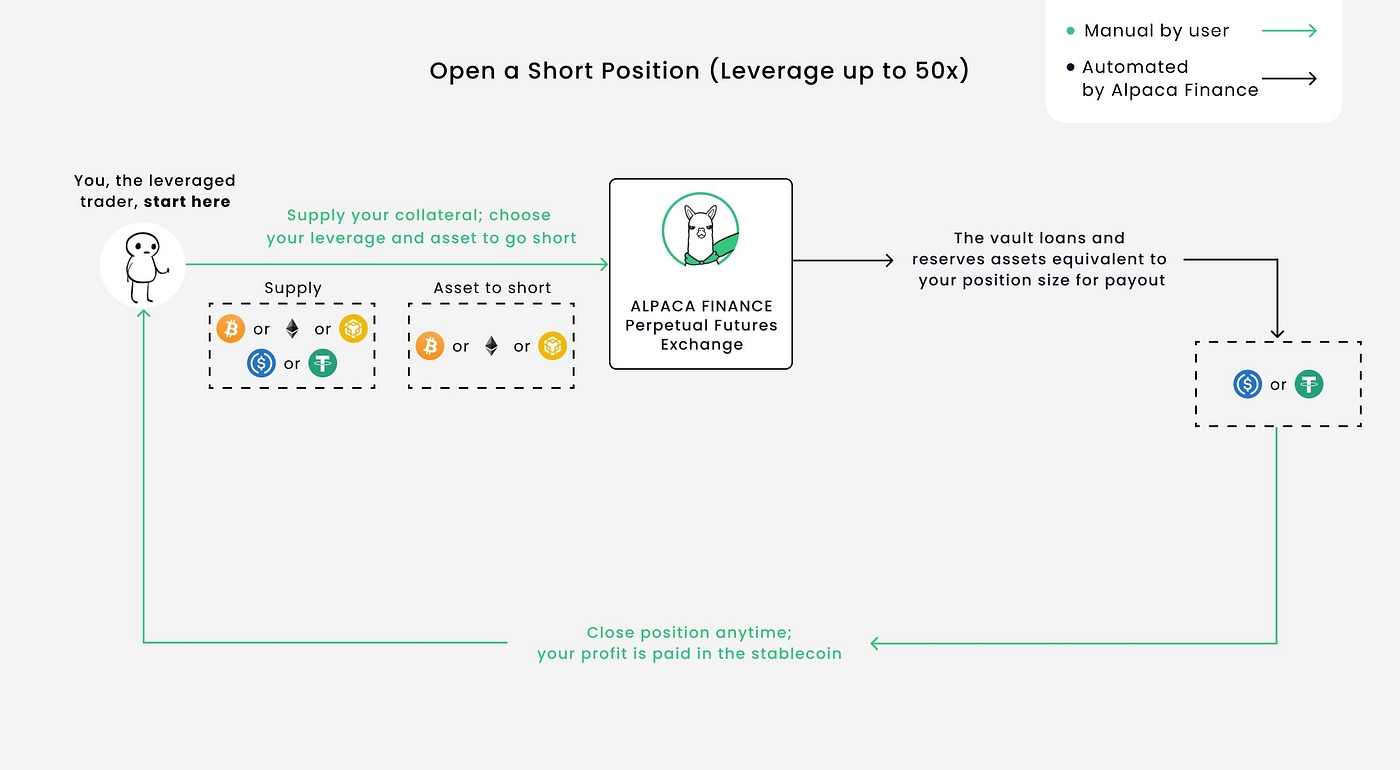

This guarantee on potential profit availability scales up to the theoretical max, which is infinite for long and down to 0 for short. Our Exchange achieves this by locking up in-kind assets from the liquidity pool when a long position is opened (i.e. reserve BTC to pay out a BTC long), and stablecoins for short positions (reserve stablecoins for a BTC short; which achieves a similar effect to how a spot short would sell the BTC at position opening). As a result, users can trade with peace of mind, knowing that the smart contracts always store enough funds for payouts and no one can misuse deposited collateral or liquidity, as has been a recent issue on CEXs.

4️. High Leverage

Alpaca’s Perpetual Futures Exchange will offer up to 50x leverage, allowing for some of the highest capital efficiency that traders can find.

High leverage will come at no additional risk of bad debt to the platform as a result of the aforementioned payout reservation mechanism. For a detailed discussion on why this is the case, please refer to this.

5️. Advanced Order Types:

Alpaca’s Perpetual Futures Exchange will support market, limit, stop-loss, and take-profit order types, giving traders immense flexibility to manage their risks and strategies.

6. Swap without price impact

Our Exchange will also act as a spot DEX, supporting swapping between assets in the liquidity pool without price impact. This is possible because instead of using the XYK AMM model, the swaps happen at oracle prices.

Traders will be incentivized to help “rebalance” assets in the liquidity pool to the desired target weight through fees & discounts.

Other guardrails will be put in place such as max/min amounts of each asset to prevent extreme unbalancing of assets.

7. Funding Rate

Similar to CEX perp exchanges, we will implement a funding rate where shorts pay longs or longs pay shorts based on the skew direction of Open Interest.

With this implementation, there can be a common scenario where funding rate > borrowing fees, meaning users will get paid to have their positions opened, which allows for a carry trade strategy.

Last updated

Was this helpful?